Financial Education - An Overview

Wiki Article

Get This Report on Financial Education

Table of Contents7 Easy Facts About Financial Education ShownThe Of Financial EducationSome Known Factual Statements About Financial Education Financial Education for DummiesGetting My Financial Education To WorkRumored Buzz on Financial Education5 Simple Techniques For Financial EducationAn Unbiased View of Financial EducationThe Main Principles Of Financial Education

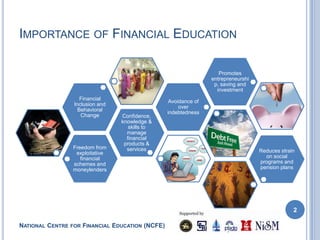

Without it, our monetary decisions and also the actions we takeor do not takelack a solid structure for success.Together, the populations they offer span a wide variety of ages, incomes, and also histories. These educators witness first-hand the influence that financial literacyor the lack of financial literacycan carry a person's life. We posed the very same question per of them: "Why is economic literacy crucial?" Here's what they had to state.

Fascination About Financial Education

Our team is happy to be producing a brand-new paradigm within college by bringing the topic of money out of the darkness. We have actually become national leaders in our area by verifying that individual monetary education and learning solutions are no more an exception for today's studentsthey are an expectation.", Director, Pupil Cash Monitoring Facility at the College of North Texas "I assume at a very early age, or perhaps later on in lifeif they have actually made inadequate decisions but discover how they can return as well as repair them and also begin intending for the future.", Supervisor of Financial Education, Virginia Lending Institution "Funds inherentlywhether or otherwise it's incredibly short-term in simply getting lunch for that day or long-term saving for retirementhelp you achieve whatever your goals are.Yearly considering that the TIAA Institute-GFLEC survey started, the ordinary portion of questions addressed properly has increasedfrom 49% in 2017 to 52% in 2020. While there's more job to be done to educate customers regarding their finances, Americans are relocating the best direction. The objective of economic literacy is to develop a feeling of control over your funds while likewise using cash as a tool to openly choose that construct higher life satisfaction, according to a 2015 record by the Consumer Financial Security Bureau (CFPB).

The Buzz on Financial Education

Do not allow the worry of delving into the financial world, or a sense that you're "simply not good with money," avoid you from enhancing your economic knowledge. There are little actions you can take, and also resources that can help you in the process. To start, make use of free devices that could currently be available to you.Several banks as well as Experian additionally supply free credit history monitoring. You can use these tools to get an initial grasp of where your money is going and where you stand with your debt. Figure out whether the company you benefit deals free financial therapy or a staff member financial health care.

8 Easy Facts About Financial Education Described

With a good or superb credit rating, you can certify for lower rates of interest on lendings and also credit score cards, credit scores cards with attractive and also money-saving benefits, as well as a variety of deals for economic items, which offers you the possibility to choose the best bargain. To boost credit report, you need to know what variables contribute to your rating. Best Nursing Paper Writing Service.This new circumstance is resulting in better uncertainty in the financial setting, in the economic markets and, undoubtedly, in our own lives. Nor need to we forget that the dilemma resulting from the pandemic has actually evaluated the of representatives and households in the.

Unknown Facts About Financial Education

As we stated earlier, the pandemic has likewise enhanced the usage of electronic networks by citizens who have actually not constantly been electronically and economically equipped. In enhancement, there are additionally sections of the population that are much less acquainted with technological advances and also are therefore at. Including to this issue, in the wake of the pandemic we have actually also seen the reduction of physical branches, particularly in country areas.One of the best presents that you, as a parent, can offer your children is the cash talk. As well site as just like keeping that other talk, tweens and also teens aren't constantly receptive to what moms and dads need to saywhether it's concerning authorization or compound interest. But as teenagers end up being more independent and also believe about life after high college, it's just as vital for them to find out concerning economic literacy as it is to do try this their very own laundry.

4 Easy Facts About Financial Education Described

Understanding how to make audio cash choices currently will certainly help give teens the confidence to make far better choices tomorrow. Financial proficiency can be specified as "the ability to make use of knowledge and also skills to manage funds effectively for a lifetime of financial wellness." Basically: It's recognizing how to conserve, expand, and also shield your money.And like any type of skill, the earlier you discover, the more mastery you'll obtain. There's no much better location to speak about sensible cash skills than at house, so children can ask questionsand make mistakesin a risk-free space. No one is more interested in youngsters' pop over to these guys monetary futures than their parents.

4 Easy Facts About Financial Education Explained

By showing children concerning money, you'll help them discover exactly how to stabilize wants and needs without entering into financial obligation. Older teens may intend to go on a trip with buddies, however with even a little monetary proficiency, they'll recognize that this is a "desire" they might need to budget and also conserve for.

Examine This Report on Financial Education

, rather of giving an automated "no," assist them comprehend that it's not totally free money.

The Ultimate Guide To Financial Education

Report this wiki page